Every company must appoint at least 1 secretary within 6 months after incorporation.

The Secretary must be a Singapore resident and cannot be the same person who is also the sole director of the Company.

The Secretary may be held liable for failure to comply with the law in certain situations.

Check out the roles and responsibilities of Corporate Secretary here

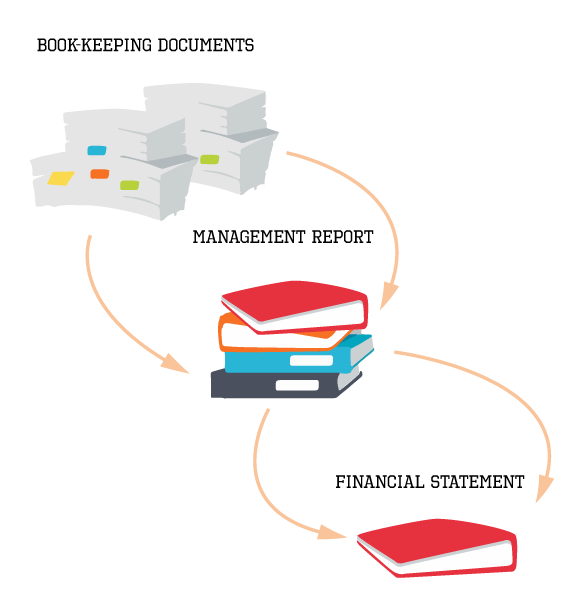

Keep proper accounting records.

“Companies are required to keep proper records and accounts of business transactions. Your company must maintain proper records of its financial transactions and retain the source documents, accounting records and schedules, bank statements and any other records of transactions connected with your business. “– IRAS (Inland Revenue Authority of Singapore)

“Every company shall cause to be kept such accounting and other records as will sufficiently explain the transactions and financial position of the company and enable true and fair financial statements and any documents required to be attached thereto to be prepared from time to time, and shall cause those records to be kept in such manner as to enable them to be conveniently and properly audited”- Companies Act Chapter 50 Section 199(1)

Recurring Annual Government Statutory Compliance

ACRA Compliance

Every company are required to hold its AGM (Annual General Meeting) after each financial year end whereby the Company’s Financial Statements are presented to the Company’s shareholders, together with highlights of major changes in the Company during the financial year.

Minutes of the meeting will be prepared by the Company Secretary and the Annual Return (AR) needs to be filed to the ACRA accordingly.

IRAS Compliance

Companies will also need to submit their yearly ECI (Estimated Chargeable Income) & income tax return (Form C/C-S), together with corporate tax computations, relevant tax schedules and the Financial Statements to the IRAS for the preceding financial year end of the Company.

Failure to comply will result in hefty penalties imposed by the authorities and may even face prosecution in court!

ACRA COMPLIANCE

Offences, Prosecutions and Penalties for Companies

Breaching of following 2 Acts

Section 175(1) - Annual General Meeting Must be held within 4 months(Listed public Company) / 6 months (any other company) after FYE.

Section 197(4) - Annual Return must be lodged within 5 months (Listed Public Company) / 7 months (any other company) after FYE.

- May require the company to pay a late lodgement fee and composition sum of up to $600.

- May result in prosecution of the directors in court and may pay up a fine (from $600 to $1200 per charge, based on past court cases.)

- May be arrested and may allow the accused to compound the breaches at $900 per breach

IRAS COMPLIANCE

Actions Taken for Late/Non-Filing

If a company fails to file the Form C-S/ C, accounts and tax computation by the due date, IRAS may take the following actions:

- Issue an estimated Notice of Assessment (NOA). The company must pay the tax amount based on this estimated NOA within one month

- Impose a composition fee not exceeding $1,000

- Issue a Section 65B(3) notice to the director

- Summon the company or person responsible for running of the company (including the directors) to Court. If the filing for any year of assessment is outstanding for 2 years or more, the penalty imposed could be twice the tax amount assessed by IRAS in addition to a fine not exceeding $1,000

How Business Tax Accountancy can help you?

Appoint us as your Corporate Secretary and Tax Agent today and we will not only ensure all your Company’s statutory obligations are met, but also provide you with our expert advice to your company business operations.

Our qualified professional staffs will also assist and guide you along with the administrative duties for your Company, so that you can better allocate precious time and resources on your business growth.

Check out our popular bundles & packages here