Many entrepreneurs are not certain of the procedures for running a business in Singapore. We aim to highlight some key points that you should know.

The Initial Set-up :

Before starting a business, it is always important to plan the business model and operation process before jumping into it. Assemble your team, appoint and hire the right person for the job. the person, be it investors or your employees, should share the same ideas and can contribute to the success of the business.

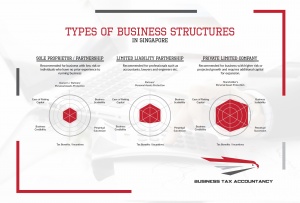

You should determine the business structure based on your company industry and primary activity. The business structure that you choose, will have many implications for you personally or the business.

Example:

- A Sole-Proprietorship or Partnership are usually recommended for small/low-risk businesses. the liability of the owner is unlimited, including personal assets.

- A Private limited company is usually recommended for businesses with higher risk or projected growth and requires additional capital for expansion. A private limited company limits the director/shareholders liability to the company’s assets.

- A limited liability partnership is usually recommended for professionals such as accountants, lawyers, and engineers. The partners have limited liability. However, they are personally liable for debts and losses resulting from their own wrongful action.

A simple illustration of the major types of business structures in Singapore.

After Determining the business structure, it is time to register the business with ACRA ( Accounting and Corporate Regulatory Authority ). Acra provides a portal “Bizfile” to allow business owners to apply and register the company online. However, many business owners are not certain or aware of the companies act requirements, missing out important documentation and regulations. This may not have an immediate impact on the business owners but may lead to penalties, fines, and even prosecution in court if left unattended.

For a further comparison of the 3 major business structures in Singapore: Read More

The Execution :

As you run the business, you are constantly working on the operative duties of the company: revising business concept and sales processes, devising new market strategies, managing of employees, office/retail space, products/goods, ensuring service quality and many more aspects of the business. A common observation is that many business owners accidentally neglected an important duty: the accounting/record-keeping of the company’s day-to-day transaction.

Do you know that all companies must meet their statutory compliance every year?

Without a proper accounting/record-keeping, you will not be able to have a clear financial status of your business. You will not be able to compute and submit your annual personal income tax and corporate income tax accurately. IRAS ( Inland-Revenue Authority of Singapore) has set a strict regulation for tax paying and will penalize individuals and companies for inaccurate filing.As a requirement by law, Singapore Companies Act (Chapter 50), (2) The company shall retain the records referred to in subsection (1) for a period of not less than 5 years from the end of the financial year in which the transactions or operations to which those records relate are completed.

You should prepare the management reports for your business – Profit and Loss Statement, Balance Sheet, Trial Balance, Bank Reconciliation Report, Cash Flow Statement, General Ledger and General Journal. You will need to prepare these reports frequently as it will give you an overview of the business’s current financial status. These report should cover the full financial year’s transaction.

Being clear about all the requirements to run a business will ensure that the business will not incur any penalties due to failure to comply with the authorities.

If you have incorporated your company and not sure what is next: Read More

Here are 3 videos to help self-employed, sole-proprietor and partnership with their record keeping brought to you by IRAS:

1)Keeping Records the Healthy Way – https://youtu.be/KfXhNIvYk0Q

2)Keeping Proper Records – https://youtu.be/ZPM6709iIBA

3)Commonly Made Mistakes – https://youtu.be/lzbXGHUhkwc

The Growth of business :

After stabilizing the business, you will be looking into the expansion and growth of the company. By now, you should be clear of all requirements and regulations of running a business in Singapore. And now is the time you look for bigger investors or potential companies that can help you grow your business. You will also be required to prepare an audit/unaudited financial statement. The financial statement will provide you with an overview of the business’s financial status of that financial year. Using these report, the management team will be able to plan for future marketing strategies, make budgeting for the next financial year, or broaden the company’s range of product and services.

You should have an up-to-date business valuation before planning to expand the company. having an up-to-date business valuation can open many opportunities for the company. As you look for potential investors or partnership with other businesses to grow your business, they will be looking at the financial status of your company to determine their risks and opportunities before making that investment or merger.

Hope for your success :

Being a successful business takes time and effort. Stay focus and persevere through difficulties.

Business Tax Accountancy wishes to assist in your business ventures, you may check out our services bundles below:

Incorporation + All-In-One Bundle

Useful sources :

The authorities have made its best effort to provide guidance to businesses and individuals. We hope you visit their respective websites for a more in-depth information and guides:

Accounting and Corporate Regulatory Authority (ACRA)

Inland Revenue Authority of Singapore (IRAS)